System and Organization Controls (SOC) reports are essential for businesses that handle sensitive client data and provide services impacting financial reporting or data security. But when it comes to its compliance, choosing between SOC 1 and SOC 2 can be confusing.

This blog breaks down the key differences, similarities, and compliance essentials when it comes to SOC1 & 2, so that organizations can make informed decisions. Whether your focus is on financial reporting or securing sensitive data, this write-up guides you through risk management, audit procedures, and best practices to achieve and maintain SOC compliance effectively.

SOC (System and Organization Controls) reports are a set of auditing standards developed by the American Institute of Certified Public Accountants (AICPA) to ensure that businesses maintain proper security, confidentiality, and financial reporting practices. These reports help organizations build trust with clients and stakeholders by demonstrating their commitment to compliance and risk management. The two most common reports, SOC1 & 2, cater to different business needs—one focusing on financial reporting controls and the other on security and privacy controls.

Compliance with SOC standards not only protects businesses and their clients but also enhances their reputation in the community. In a world where data breaches and financial misreporting can cripple organizations overnight, SOC compliance acts as a safeguard. It reassures clients that the company has robust controls and procedures in place, mitigating risks associated with data handling and financial inaccuracies.

Here are some crucial reasons why SOC compliance is essential for businesses:

SOC 1 focuses on the internal controls relevant to a service organization’s impact on financial reporting. It is primarily designed for organizations that process financial transactions, ensuring that their controls effectively prevent errors, fraud, or misstatements in financial data.

For example, a payroll service provider handling the salaries of thousands of employees must ensure accurate financial reporting to prevent incorrect payments or compliance issues. Similarly, a SaaS provider offering accounting software must validate that its platform correctly processes transactions, maintains data integrity, and aligns with financial regulations. Financial institutions, such as banks and investment firms, also require SOC 1 compliance to safeguard the accuracy and reliability of their financial statements, fostering trust with stakeholders and regulatory bodies.

Key Aspects of SOC 1:

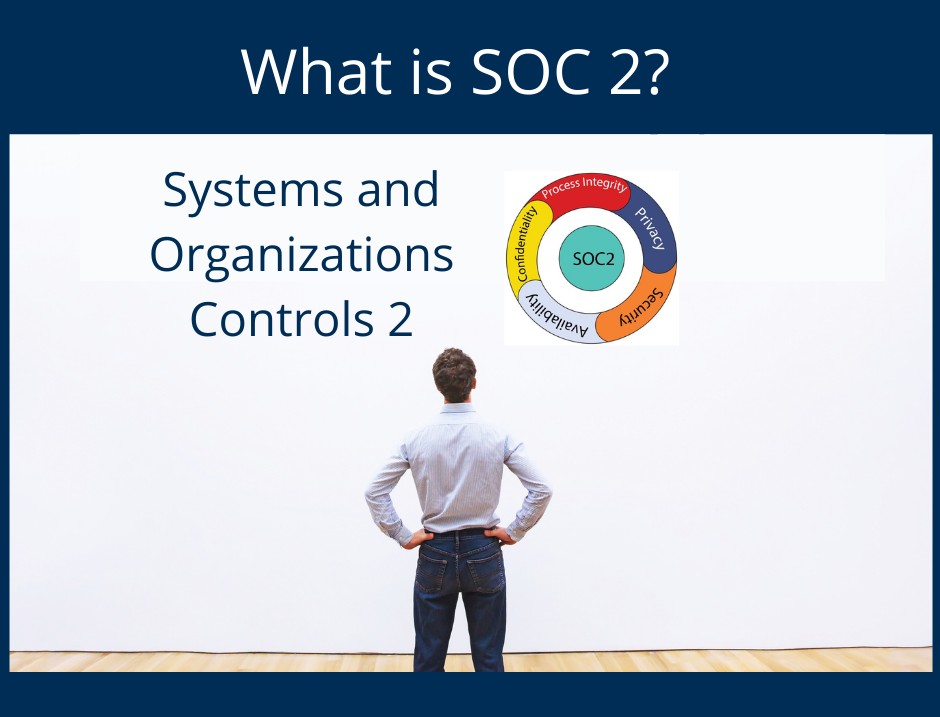

SOC 2 focuses on a service organization’s controls related to data security, availability, processing integrity, confidentiality, and privacy, al of which make up the Trust Service Criteria (TSC). It is widely used by technology and cloud service providers to ensure that customer data is securely managed and protected against breaches.

For example, a cloud storage provider handling sensitive business data must implement strict security measures to prevent unauthorized access, ensuring compliance with SOC 2 standards. Similarly, a SaaS company managing customer information must have robust access controls, encryption protocols, and monitoring mechanisms to maintain data integrity and availability. By adhering to SOC 2 principles, these organizations can reassure clients that their systems are designed to handle data securely and responsibly, fostering trust and compliance with industry regulations like GDPR and CCPA.

Key Aspects of SOC 2:

| Feature | SOC 1 | SOC 2 |

| Purpose | Financial Reporting | Data Security & Privacy |

| Focus Area | Internal controls affecting financial statements | Trust Services Criteria (TSC) |

| Audience | Financial institutions, Payroll providers | SaaS, Cloud providers, IT service companies |

| Regulatory Alignment | SOX Compliance | GDPR, CCPA, NIST |

| Report Types | Type I & Type II | Type I & Type II |

If you are looking to add expertise in SOC 1 and SOC 2 compliance to your repertoire, stay tuned for CyberFrat‘s upcoming SOC 1 & 2 Training Program, designed to equip professionals with a deep understanding of audit procedures, compliance requirements, and risk management strategies for SOC frameworks. Our expert-led training will provide hands-on insights, real-world scenarios, and best practices to help organizations achieve and maintain SOC compliance effectively. Enhance your skills and become a trusted professional in securing financial and data-driven environments.

For more Visit our website https://cyberfrat.com/soc

Written By

Tamanna Agrawal

Assistant Manager – Operations, CyberFrat